If you haven’t experienced the “recovery” from the Great Recession the corporate media keeps insisting is here, that’s because “quantitative easing” is a new way to say “trickle-down.” In this latest version, the Federal Reserve has pumped trillions of dollars into financial markets to create a stock market bubble.

Other than a small secondary effect of re-animating real estate prices, a growing bubble in stock prices has constituted the extent of the economic impact. Good for the one percent, not so good for the rest of us.

“Quantitative easing” is the technical name for a Federal Reserve program in which it buys U.S. government debt and mortgage-backed securities in massive amounts. In conjunction with keeping interest rates near zero, quantitative easing is supposedly intended to stimulate the economy by encouraging investment. A reduction in long-term interests rates would encourage working people to buy or refinance homes; for businesses to invest because they could borrow cheaply; and push down the value of the dollar, thereby boosting exports by making U.S.-made products more competitive.

In real life, however, the effect has been an upward distribution of money and an increase in speculation. This new form of trickle-down has not worked any differently than it did during the Reagan administration. Now that the Federal Reserve will gradually reduce the amount of bonds it purchases (announced last month) and perhaps end the program by the end of 2014, Wall Street and corporate executives worry that their latest party might be over.

What hasn’t changed, and won’t anytime soon, is the weakness of the global economy, particularly for the world’s advanced capitalist countries. If you aren’t making enough money to get by, you aren’t planning a shopping spree. If working people, collectively, continue to see wages erode, happy days are not at hand. They aren’t.

The top one percent has captured almost all of the “recovery,” which is why the corporate media continues to peddle its mantra. Emmanuel Saez, an economist at the University of California, calculates that 95 percent of all U.S. income gains from 2009 to 2012 went to the top one percent. That result is an intensification of a pattern — Professor Saez calculates that 68 percent of all income gains for the longer period of 1993 to 2012 went to the top one percent.

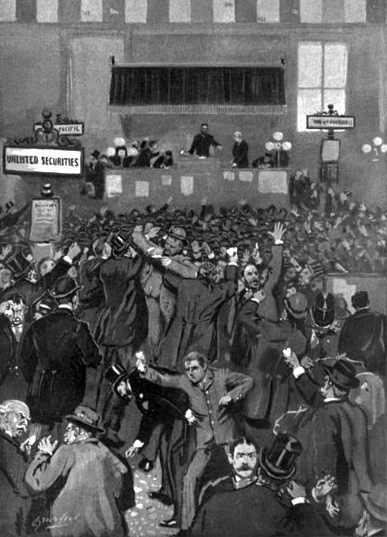

Fueling a speculative binge

How is this connected to quantitative easing? The money borrowed by corporations has not gone toward investment or hiring new workers, but rather into buying back stock and speculation. Financiers and executives riding the crest of this wave of cheap money in turn use their gains to further speculate, or to buy expensive works of art, itself speculation that the wildly rising prices for collectible works will continue.

U.S. corporations bought back about $750 billion of their stock in 2013. When a corporation buys back its stock, it is spreading its profits among fewer stockholders, thereby boosting its stock price. That’s more profits for financiers and bigger bonuses for executives, achieved without investing in the enterprise.

The billionaire Stanley Druckenmiller in a television interview called the Federal Reserve’s quantitative easing program:

“[T]he biggest redistribution of wealth from the middle class and the poor to the rich ever. … I mean, maybe this trickle-down monetary policy that gives money to billionaires and hopefully we go spend it is going to work. But it hasn’t worked for five years.”

Mr. Druckenmiller said this on CNBC, a cable-television business news station whose anchors openly cheer news of rising corporate profits and celebrate wealth accumulation. The “five years” he mentioned is a reference to the three successive programs of quantitative easing that began in the final weeks of the Bush II/Cheney administration. In a separate report, CNBC journalist Robert Frank writes that it has become “increasingly clear” that the wealthiest one percent are the big winners:

“The largesse of the Federal Reserve over the past five years has amounted to one of the largest ever subsidies to the American wealthy — fueling record fortunes, record numbers of new millionaires and billionaires, and an unprecedented shopping spree for everything from Ferraris to Francis Bacon paintings. The prices of the assets owned by the wealthy, and the things they buy, have gone parabolic, bearing little relationship to the weak, broader economy. …

Fed policy has fueled a surge in the value of financial assets. Since the wealthiest 5 percent of Americans own 60 percent of financial assets, and the top 10 percent own 80 percent of the stocks, those gains in financial assets have gone disproportionately to a small group at the top.”

Stock prices reaching unsustainable levels

More speculative money is poured into stock markets because the heavy Federal Reserve buying of bonds dampens demand in that sector. Ted Levin, writing for the business publication SmallCap Network, summarizes this effect:

“[Q]uantitative easing involves buying long-term bonds, which in turn drives down the interest rates on these. The reason for this is that when there is a strong demand for bonds — which is exactly what quantitative easing artificially creates — bond issuers do not have to offer such high interest rates in order to attract investors. This in turn means that bonds are less attractive to non-governmental investors, and so they turn to stocks instead — driving up the price.

The second reason is that quantitative easing makes more capital available to businesses at lower rates. This allows them to swap high-cost debt for low-cost debt and buy back stock — improving their earnings per share and driving up the value of the remaining stock.”

The most basic measure of a stock, or the stock markets as a whole, is the “price/earnings ratio.” The P/E ratio is a company’s yearly profit divided by the price of one share. As of January 14, the P/E ratio for the S&P 500, the standard barometer, was at about 19.5 and has been rising steadily the past couple of years. A handful of times in history, the P/E ratio has risen above 20, only to crash each time. The historical average is 14.5 — meaning that stocks are currently overvalued.

Stock prices have become unmoored from underlying economic conditions — and are frequently pure speculation. Most trading is done through computer programs, often with a stock bought and sold in fractions of a second to take advantage of quick pricing changes, and increasingly exotic derivatives to draw in ever more speculative money by the wealthy who are awash in far more money that can possibly invest rationally.

Wall Street’s party will wind down as slowly and gently as the Federal Reserve can manage, and it may yet reverse itself and continue its quantitative-easing program. As of the end of December 2013, the Fed has spent a total of $3.7 trillion over five years on quantitative easing and the Bank of England has committed £375 billion to its quantitative easing.

How much could these enormous sums of money have benefited working people had this money instead been used to create jobs directly or for productive social investment? And these barrels of money thrown to financiers are merely the latest tranches — the U.S., E.U., Japan and China committed 16.3 trillion dollars in 2008 and 2009 alone on bailouts of the financiers who brought down the global economy and, to a far smaller extent, for economic stimulus. For the rest of us, it’s been austerity and mounting inequality.

Going beyond the obvious question of why such absurdly one-sided policies should be tolerated, it also necessary to ask: Why do we continue to believe an economic system that requires such massive subsidies “works”?

Central is deceptions by omission.

“The Public Be Suckered”, see here:

http://patrick.net/forum/?p=1230886

Please be the exception and inform the people!

Interesting that even Goldman Sachs is warning about the stock market bubble and predicting a 10% drop. Translation: the big boys have already pulled their money out. Only the suckers (including pension funds) will take the hit.

I suspect they haven’t moved their money just yet. When I worked at Dow Jones Newswires during the 1990s bubble, I was always struck by how frequently traders would say, “This can’t go on. But as long as it lasts, I have to stay in.” The bubble always bursts, but nobody can know when, or what the precipitating cause will be. The 1990s bubble was inflated well beyond any historic precedent, I suspect to the surprise of even most investment bankers.

This one will not last anywhere near as far, but the dips in the stock markets since the start of January is a sign of uncertainty. Nonetheless, financial markets are rigged casinos, so Goldman Sachs et al. will find a way to profit off the rest of us no matter what happens.

Well it is comforting to know we are as fucked as I thought!

Excellent post SD, like always.

Quantitative easing in the UK amounted to £375 billion. So the Bank of England buy up assets. These assets are bonds which are created by commercial banks and other financial institutions.

The aim of the plan was to get banks lending again. It has of course been a miserable failure in that respect.

A few points;

All our money is fiat and is backed by the Government of which the £pound is the only legal tender. Legal tender means that a person/business/tax must accept it as payment or as a token of value.

Almost all money in circulation has been created as a debt by a bank. A loan to an individual or a business is the banks asset.

In the UK, the old idea of Fractional Reserve Banking is long dead. Banks can and do create credit which for all practical circumstances is money. Banks don’t lend other people’s money, this is a myth.

If the government really wanted to get the economy moving they could have deposited the equivalent of £375 billion as a share into each persons current account. I think that’s around £15,0000 each.

They didn’t do this as it’s against their ideology plus it would likely be spent on imported goods because we no longer have the manufacturing capability to make the stuff which people need or want.

The whole idea of austerity is a massive con, people are duped into thinking that money is somehow real. The commercial Banks, the Bank of England, the Fed can and do create money at the click of a button.

There are of course other solutions but our politicians are so stuck inside a framework based on ideological thinking, they can’t see the woods for the trees.

As I sit here writing this I can bask in the warm glow of a house which has now gone up in value when compared to last year. What did I do to create this value? Nothing, zilch, nada. It just happened like magic and it makes me sick.

Our next great bubble is of course house prices. In the 1960’s an average house could be bought for around 3 times one persons average salary. In 2014 an average house can now be bought for around 7 or 8 times one persons average salary. D’oh

£15,0000 for everybody? Now that would be a real stimulus. But, as you correctly pointed out, it would go against prevailing ideology. Or, alternatively, the government could have used that money to create jobs. But not in this system …

what else can you expect from these “one trick ponies”?

Let’s us hope grownup adults will stop paying attention to this stale computer game (where is the ball now)

once they realized it’s the same old Ponzi-scheme – just between the Fed and Big Banks playing Ping-Pong – after these 5 years?

The Only way this would Still exist is because some folks can still heat the house by burning their furniture. If everyone else refuse to believe in this Fairy anymore, this scheme is SO gone. No more useless distractions/ theatricals/ Noises.

Then a democratic government will really need communicate with their voters and deliver. Simple as that! when people have the self confidence to face the real world and invest in their new future.

The best way to rob a central bank (Federal Reserve) is to own one. Take the power to create and control the nation’s money supply from privately owned central banks and return that enormous power to the people in the form of a publicly-owned central bank. Sovereign nations with sovereign people taking control of their monetary affairs? Too simple an idea to be realistic… right? View the documentary “The Secret of Oz”. Listen to Ellen Brown.

Thanks,

Jerry

Powers concentrated on this Titanic system can only rearrange the furniture and move Abstract Number games on their computers. Money cannot stop the cracks for very long (30 days cycles).

Low real estate, PURPLE fiat/ carbon rationing, battering/sharing, ecological value economy, end Cold War… anyone have ideas?

Jerry, thanks for giving me an opportunity to discuss the ownership of central banks. I’ve not understood the stress that some place on the Federal Reserve supposedly being “private.” It’s a part of the government — the president picks the board of governors, the Senate approves. Perhaps the angst over the Fed being “private” derives from the fact that the Fed more egregiously does the bidding of the industry it supposedly oversees than other branches of the government. And bankers do sit directly on many of its branch seats.

The true problem with the Fed, and all capitalist central banks, is that they are undemocratic, unaccountable and completely in the service of the financial industry. What difference does it make who “owns” it? A central bank is a necessary tool of a capitalist economy. Without it, the economy would be even more unstable and the banks would print money themselves. That was the case before the Fed’s creation. In other words, the banks would be even more in control than they are now.

As I’ve written before, the problem isn’t the central bank, it’s the system the central bank serves. The entire banking system, not only the central bank, needs to be brought under democratic control, drastically shrunk and re-oriented toward rational investment and social necessity.

One of the biggest misconceptions citizens have is that the Federal Reserve System is a governmental institution like the Departments of State, Energy, Defense, Education, etc. The Federal Reserve is as much a part of the government as Federal Express. Continuation of the Federal Reserve is the same as keeping the fox in charge of the henhouse. It was only a “coincidence” that federal taxes began to be collected in 1913, the same year the Fed was created. The quantitative easing of $trillions should have gone directly into the bank accounts of American citizens, instead of a “back door bailout” of banks.

If the US gov’t had a public bank instead of the Fed from 1913-2014 there would be zero national debt; the same holds for the 50 states. Democratic control equals: in the control of all the people, as a public utility institution controlling the quantity of money, not just the wealthiest few operating without oversight, through the actions of the Fed in the interests of its owners. The Fed owns the money power. That immense power belongs in the hands of the people. The government can create the money. The constitution directs the government to create the money.

Andrew Jackson said it in his farewell address in 1837:

“The mischief springs from the power which the moneyed interest derives from a paper currency which they are able to control, from the multitude of corporations with exclusive privileges which they have succeeded in obtaining… and unless you become more watchful in your States and check this spirit of monopoly and thirst for exclusive privileges you will in the end find that the most important powers of Government have been given or bartered away, and the control of your dearest interests have been passed into the hands of these corporations.”

Thomas Jefferson in 1799:

“I sincerely believe that banking establishments are more dangerous than standing armies and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling on a large scale.”

John Calhoun in 1836:

“A power has risen up in the government greater than the people themselves, consisting of many, and various, and powerful interests, combined into one mass, and held together by the cohesive power of the vast surplus in the banks.”

Thomas Edison in 1921:

“If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good, makes the bill good also. The difference between the bond and the bill is the bond lets money brokers collect twice the amount of the bond and an additional 20%, whereas the currency pays nobody but those who contribute directly in some useful way. It is absurd to say that our country can issue $30 million in bonds and not make $30 million in currency. Both are promises to pay but one fattens the usurers and the other helps the people.”

Thanks,

Jerry

I’d rather not belabor this point, but the Federal Reserve is a part of the U.S. Treasury Department. Stockholders pick the leadership of Federal Express, not the president and without needed approval of the Senate. Rather than my repeating my arguments, I’d like to suggest you read “It’s not the Federal Reserve, it’s the system it serves,” linked among the “related” links at the bottom of the main text above.

Once again, this is, in my opinion, a pointless debate — the Fed is an undemocratic organization and it can not be otherwise in a capitalist economy; whether or not it is “private” or “public” makes absolutely no difference. The solution is not to reform a capitalist central bank, it is to create an economy geared toward human need and under full democratic control. A fully democratic, and drastically smaller, banking sector, in which speculation does not exist, would be a linchpin of such an economic democracy.

Well, at least there is one thing we agree on: this is a pointless debate.

Thanks,

Jerry

Spot on and well-said. This system is corrupt and damaging in many ways. While it generates great wealth for the speculators, it simultaneously robs savers and the prudent. By artificially keeping interest rates low to pump up asset bubbles, the Fed effectively steals the savings of the elderly and retirees, who are unable to earn a market rate of interest on their savings. They either have to jump in with the speculators in an attempt to earn the income they need (the most prudent are always the last to jump into a bubble about to burst and therefore the ones who suffer the most when it inevitably explodes) or they have to watch helplessly as their savings are melted away by the inflation created by the manipulation of the interest rates. It’s little better than outright theft.

And by eliminating traditional, defined-benefit pensions, more people are forced into stock markets, thereby creating more opportunities for financiers to steal other people’s money.

[…] that with the booming Fed-financed stock market, and one has some pretty strong evidence that the elite has decided to crack down on everyone else. […]

The real problem is that “money” is now pieces of paper or pieces of computer code,but,most people still believe this “money” has value. It won’t take much for that belief to diminish.

Or,in other words,quanitative easing,is improbable,with gold backed money.

Money has value because there is broad social agreement that it does. That is all that is necessary.

Quantitative easing is impossible with gold-backed money, but so is any form of useful stimulus. To go back on the gold standard (impossible in today’s complex capitalist economy) would be to impose the most pitiless austerity, with government unable to put forth any program to ease an economic crisis. The world’s money supply would be regulated by a handful of multi-national mining corporations. In the past, only a minuscule lunatic fringe advocated for a return to the gold standard; that some libertarians have more recently taken up this “cause” is far more a reflection on them than anything else.

I’m not recommending a return to a Gold Standard,I’m just saying that the nature of Fiat money is to become worthless. In terms of monetary policy,those from the middle to the bottom,are between a rock and a hard place./fiat money =s rock;asset backed money =s hard place.

But all money is ultimately “fiat.” We agree that it has value and we use it for our transactions and accept our wages in it. What “backs” it — a metal or the stability of the government — doesn’t change that equation. The British pound seems to have avoided becoming worthless for quite a long time now, to cite merely one counter-example.

This or that local currency, in extraordinary circumstances, could drastically be reduced in value through a local episode of hyper-inflation, but there is no tendency that can be cited as a rule as to the long-term worth of a currency. And given current monetary policy that is overly obsessive about inflation, and the continuing slump in wages, money is not about to become worthless. Nowadays, if a currency drastically drops in value, it is due to manipulations by foreign-exchange speculators, an entirely different question (and it is only smaller countries that face this particular threat).

“In June, 2009 happy talk appeared about “the recovery,” now 4.5 years old. As John Williams (shadowstats.com) has made clear, “the recovery” is entirely the artifact of the understated measure of inflation used to deflate nominal GDP. By under-measuring inflation, the government can show low, but positive, rates of real GDP growth. No other indicator supports the claim of economic recovery.

John Williams writes that consumer inflation, if properly measured, is running around 9%, far above the 2% figure that is the Fed’s target and more in line with what consumers are actually experiencing. We have just had a 6.5% annual increase in the cost of a postage stamp.”

This came from Paul Craig Roberts at CounterPunch today. What do you think?

Without better knowledge of John Williams’ methodology, I have no way of evaluating this alternative measure of inflation. To be sure, there is no recovery for the 99 percent, regardless of how we measure inflation. I did read the Paul Craig Roberts article — that the author is a former Treasury official and former Wall Street Journal reporter does add to his credibility; folks with his credentials ordinarily don’t put forth such honest criticism.

To me, it doesn’t matter if the figures of very slow positive growth in GDP are real or manufactured through manipulation of inflation statistics. The very concept of GDP is flawed, for, among other reasons, that if there is a rise in economic activity and it all goes to the very top, the resulting increase in GDP is pretty meaningless for the average working person. Certainly, if we use a metric that includes the decline in wages since the 1970s (especially when measured against gains in productivity), our purchasing power has declined.

[…] [21] http://www.zerohedge.com/news/2014-10-21/19-surprising-facts-about-messed-state-us-economy [22] systemicdisorder.wordpress.com/2014/01/15/federal-reserve-inflates-bubble/ [23] […]

[…] https://systemicdisorder.wordpress.com/2014/01/15/federal-reserve-inflates-bubble/ […]

فوركس

فوركس السعودية اون لاين http://forexonline-ar.com