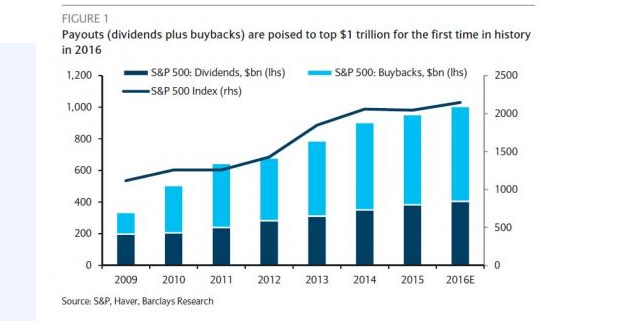

Class warfare is poised to reach a new milestone as this year’s combined total of dividends and stock buybacks by 500 of the world’s largest corporations will exceed US$1 trillion.

So large is that figure that, for the second year in a row, the companies comprising the S&P 500 Index (a list of many of the world’s biggest corporations) will pay out more money in dividends and stock buybacks than the total of their profits. Yes, times are indeed good for speculators. Not so good for employees — you know, the people who do the actual work — whose pay is stagnant or declining so that those at the top can scoop up still more.

Although dividends, a quarterly payment to holders of stock, are steadily increasing, the increase in stock buybacks has been steeper. The total of these has tripled since 2009 as financiers and industrialists feverishly extract as much wealth as they can. This is part of why the “recovery” since the 2008 economic collapse has been a recovery only for those at the top.

In short, a buyback is when a corporation buys its own stock from its shareholders at a premium to the current price. Speculators love buybacks because it means extra profits for them. Corporate executives love them because, with fewer shares outstanding following a buyback program, their company’s “earnings per share” figure will rise for the same net income, making them look good in the eyes of Wall Street. Remaining shareholders love buybacks because the profits will now be shared among fewer shareholders.

Wall Street and corporate executives both win! Hurrah! Who could by hurt by this? Oh, yes, the employees. They’ll have to suffer through pay freezes, work speedups and layoffs because the money shoveled into executive pay and financial industry profits has to come from somewhere. This sort of activity helps buoy stock prices. So does the trillions of dollars the world’s central banks have printed to sustain their “quantitative easing” programs.

We’re not talking loose change here. The U.S. Federal Reserve pumped $4.1 trillion into its three rounds of quantitative easing; the Bank of England spent £375 billion; the European Central Bank has spent about €1.34 trillion; and the Bank of Japan has spent ¥220 trillion so far. That’s a total of US$8 trillion or €7.4 trillion. And the last two programs are ongoing.

Encouraging investment or inflating bubbles?

The supposed purpose of quantitative-easing programs is to stimulate the economy by encouraging investment. Under this theory, a reduction in long-term interest rates would encourage working people to buy or refinance homes; encourage businesses to invest because they could borrow cheaply; and push down the value of the currency, thereby boosting exports by making locally made products more competitive.

In actuality, quantitative-easing programs cause the interest rates on bonds to fall because a central bank buying bonds in bulk significantly increases demand for them, enabling bond sellers to offer lower interest rates. Seeking assets with a better potential payoff, speculators buy stock instead, driving up stock prices and inflating a stock-market bubble. Money not used in speculation ends up parked in bank coffers, boosting bank profits, or is borrowed by businesses to buy back more of their stock, another method of driving up stock prices without making any investments.

The practical effects of all this is to re-distribute income upward. That is the raison d’être of the financial industry.

What else could be done with the vast sums of money thrown at the financial industry? In the U.S. alone, home to a steadily crumbling infrastructure, the money needed to eliminate all student debt, fix all schools, rebuild aging water and sewer systems, clean up contaminated industrial sites and repair dams is estimated to be $3.4 trillion — in other words, $700 billion less than the Federal Reserve spent on its quantitative-easing program.

The British think tank Policy Exchange estimates Britain’s needs for investment in transportation, communication and water infrastructure to be a minimum of £170 billion, or less than half of what the Bank of England spent on its QE scheme.

Borrowing to give more to speculators

To return to the $1 trillion in dividends and buybacks, a research report by Barclays estimates that those payouts by S&P 500 corporations will total about $115 billion more than their combined net income. As a Zero Hedge analysis puts it:

“[C]ompanies will promptly send every single dollar in cash they create back to their shareholders, and then use up an additional $115 billion from cash on the balance sheet, sell equity or issue new debt, to fund the difference.”

Near-zero interest rates, another central bank policy that favors the financial industry, have enabled this accumulation of debt. Debt not for investment, but simply to shovel more money into the pockets of financiers and executives. But debt can’t increase forever, and someday, perhaps in the not too distant future, central banks will raise interest rates, making debt much less attractive. The Barclays report calculates that 2015 also saw buybacks and dividends total more than net income; the last time there was consecutive years in which this happened were 2007 and 2008.

It would of course be too simplistic to interpret this metric as a signal that an economic collapse on the scale of 2008 is imminent, but is perhaps a sign that the latest stock market bubble may be close to bursting.

It would of course be too simplistic to interpret this metric as a signal that an economic collapse on the scale of 2008 is imminent, but is perhaps a sign that the latest stock market bubble may be close to bursting.

Another signal that trouble may be looming is that money is now being shoveled into bonds, a sign that confidence in the stock market is waning. A New York Times report suggests that European and Asian investors (the Times of course is much too genteel to use the word “speculator”) are pouring so much capital into U.S. bond markets that a bubble is being inflated there as well. These speculators are seeking higher returns from bonds floated by U.S. corporations than they can get at home. The Times reports:

“The surge in flows echoes a wave of investment in the years right before the financial crisis, when mostly European investors snapped up billions of dollars of mortgage-backed securities before the American housing market imploded.

The current numbers are also arresting. According to [former Treasury Department official Brad W.] Setser’s figures, about $750 billion of private money has poured into the United States in the last two years alone.”

Starved for investment

Setting aside the touch of xenophobia in it, the Times report does at least broach the subject of under-investment. And wealthy investors possessing far more money than can possibly be invested is hardly an unknown phenomenon. As an example, let us examine Wal-Mart, which racked up more than $16 billion in net income for 2015 and seems poised to better that this year.

The Walton family, heirs to founder Sam Walton, owns about half of Wal-Mart’s stock and receive a corresponding share of the billions of dollars in dividends the company pays yearly. It also spends billions more buying back stock annually, an indirect help to the Waltons. This is a company notorious for dodging taxes while paying its employees so little they require government assistance, and is the recipient of vast amounts of government handouts.

The Waltons make tens of thousands times what their ill-paid employees earn. They certainly don’t work tens of thousands harder — or even work at all, as the billions roll in just for being born into the right family. Wal-Mart is far from alone, but does provide an exemplary example of class warfare. An estimated $1 trillion a year goes to corporate profits that once went to wages, according to a PBS Newshour report.

The harder you work, the more the boss, and financiers, make. What sort of system is this?

THIS sort of system, as old as civilization itself. As you know, “radical” means going to the root, digging down to the origin of something so that it can be clearly understood and, if necessary, addressed and altered on a fundamental level. The hyper-exploitation we are now experiencing has a long, long history, and one of the reasons that we on the left struggle in frustration to eradicate it may be that our field of vision is restricted–that we have not gone deep enough in our analysis.

Thank you for giving us the proper definition of “radical.” I always hate it when I see “radical” used as a synonym for “extreme.” Those are two different things.

All of recorded history has taken place in systems and times when people struggled against massive inequality, mostly in times of shortages. There is enough for everybody today, if only it were distributed fairly.

Yes, all of recorded history is so. Which is why Gilk’s thinking, drawing upon Lewis Mumford and other historians who have shed some light on the prehistoric agrarian village (and its conquest, resulting in exploitative and militaristic empire) is so provocative and potentially useful–useful in trying to figure out ways to extricate ourselves from pending suicide/ecocide, which is these days the undercurrent of our fragile, frustrated existence.

The world is nearly drowning in more wealth, food and material goods than ever before in human history; I can agree with “…enough for everybody….distributed fairly.” but wouldn’t “massive inequality” require an equally massive system to redress that inequity?…..a system that is as prone to greed, graft and corruption as any other? It seems to me that we are witnessing the “overshoot” stage of this bloated, obscene financial system….knowing that “die-off” is the logical next step in the cycle is frightening, as me and mine are likely to be counted in the collateral damage. In response to that fear we have gradually become more “radical” in certain ways: the roots of our lives are literally in the soil, so we have chosen to spend/invest money in land, tools and infrastructure that will allow us to at least feed ourselves when the SHTF. Conventional wisdom (oxymoron alert!) derides us for not investing in RRSPs, mutual funds, GICs etc. etc. but we feel safer placing our faith in real soil than in hallucinated “wealth” managed by some slick, anonymous computer jockey. “What sort of system is this?”……the sort that is inevitable when mere money is substituted for real, natural wealth.

We live in an economic system that is designed to, and inevitably does, funnel more and more wealth into fewer and fewer hands. It is a system that requires continual growth, and infinite growth on a finite planet is impossible. Then there is the environmental destruction and global warming and plenty else. We can’t fix massive inequality within capitalism. At best, mass movements can win reforms, but those reforms will eventually be taken away, and are.

So we have to create a different system, one that is based on human need instead of private profit. One in which everybody has enough to live and is sustainable. I, and many others, call such a system “socialism.” Others would prefer other terms. We can call it economic democracy. We’ll have to find a way to bring into such a system, a better world, or much worse will be in store for us and especially our descendants.

There is no short cut to this and perhaps it will be the biggest struggle humanity has ever waged. Refusing to cooperate with capitalism, as many commentators on this blog have said, is a good place to start, although individual solutions won’t solve the structural problems. No single action can possibly be more than a portion of a solution, but I have no desire to discourage you, and we do need to start somewhere.

Refusing to be complicit with capitalism translates into this – I am so exhausted from working my zero hour contract which lasts for six months when I will be replaced. It has no sick pay. I am driven to work all hours, at any hour, on any day should it be ‘operationally necessary’. My basic hours are changed weekly and shift pattern changed with as little as one day’s notice. I have no home life and cannot plan anything with my family. I will be forced to take six hours holiday generated by the computer and another 15 decided by the first rung of management. All traces of my own requests have been removed from the computer by same. A full week’s holiday will be allowed at the end of February on a contract that started in mid August. Breaks of 15 minutes for six hours and 30 minutes for 8 hours are not paid. You are encouraged to sign away your rights to a limit of 48 hours weekly. The firm’s recruitment and training budget is kept to a minimum for these cyclic recruitment drives so we are interviewed/trained by existing sales staff. The zero hour contract we are now tied to is not mentioned and we are given a print out of our hours and shift pattern with no mention of it changing. Agreement to the actual contract is activated when you click on the link in your email which takes you to the HR site requesting bank details for your payment. No-one has a written copy of the contract (except me who was lucky enough to speak to a disgruntled HR member where the department was being drastically downsized to increase profits). It also has an exclusivity clause. None of this double dealing is suspected by the employee as the company is one of the most famous in Britain and one assumes a degree of integrity will be employed.

So – back to fighting capitalism. I left yesterday after giving a week’s indication of this fact verbally as I refused to acknowledge anything other than the verbal contract I agreed to on the day of my interview/job offer. I have no job, no income and may have put myself in the position of voluntary giving up a paid job which will mean no unemployment benefits for 26 weeks. My situation shows the praxis of fighting capitalism – not the theory.

Greetings, Michelle. Best of luck to you. What you describe is increasingly the norm in the neoliberal stage of capitalism, but not, as so many mistakenly believe, some mutant stage of capitalism. Rather, neoliberalism is the development of capitalism operating through its usual laws.

Reblogged this on Gaia will prevail.

Such is the irrational and arbitrary economic system of capitalism, Mr. Dolack. A system that rewards the most greedy and avaricious few at the expense of the hard-working many.

When, if ever, will Americans wake up? I try to tell people that the wealthiest 60 Americans have as much wealth as the bottom 115 million souls living in poverty or very near it. They mostly smile wistfully as if I were waving a magic wand and ask, “yea, but did ya’ hear about those cubs!”

Sigh. Is it hopeless or is it simply beyond hope…?

We’d better have hope or what’s the point? So let us keep trying …

[…] central banks of Britain, the European Union, Japan and the United States have shoveled a colossal total of US$8 trillion (€7.4 trillion) into their “quantitative easing” programs — that is, programs that buy […]

I predict that if things don’t change in favour of the ordinary worker/consumer the whole damm system will collapse and bury the companies and us under a mountain of poverty and violent revolution and it won’t be pretty!

The longer the working people of the world wait to get rid of capitalism, the harder the task will be. The future, I fear, may well not be pretty.